| Twice-weekly summary of financial industry news |

|

| Top News |  |  |

|

| Policy Watch |  |  |

|

- CFPB could seek a role in retirement policy

The Consumer Financial Protection Bureau is exploring whether it has any authority over Americans' retirement savings and investments, says Richard Cordray, the agency's director. The CFPB is concerned that consumers might become victims of financial scams, sources say. Bloomberg

(1/18)

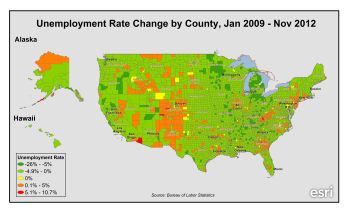

- Mapping the economy as Obama begins his second term

President Barack Obama faces a different economic landscape than he did four years ago. This post features interactive maps that show state and local data that shape national economic indicators such as unemployment and median household income, and it looks at demographic trends and how they will affect the U.S. for the next four years. SmartBrief/SmartBlog on Finance

(1/18)

| Building Your Business |  |  |

|

- Report: Advisers should expect more contact from affluent clients

Wealthy clients communicate with their financial advisers more frequently than do those with less money, a report finds. Affluent clients spend more than half their communication time connecting digitally, and they expect their wealth advisers to do likewise, says the report from SEI, Scorpio Partnership and Standard Chartered Private Bank. Financial-Planning.com

(1/15)

| Financial Products |  |  |

|

- Target-date funds performed well in 2012

Target-date funds posted strong returns in 2012, Morningstar analyst Josh Charlson writes. Overall, performance was strong for near-retirees and for young workers, ranging from 10.7% on average for short-range funds typically held by older workers to 14.7% for longer-range funds. Morningstar

(1/17)

| Retirement Focus |  |  |

|

- Study questions wisdom of 4% rule as yields remain low

The traditional 4% withdrawal rule used by retirement planners is a "risky strategy" in today's low-yield environment, a study co-author says. The early years of retirement have a "disproportionate impact on failure rates," which could reach 57% based on 2013 yields, researcher Michael Finke says. Advisers should "start with having a more conservative approach to estimating retirement income," says Finke, who suggests that annuities can offer some protection. AdvisorOne

(1/17)

| FSI Member News & Events |  |  |

|

- Don't Miss OneVoice 2013!

Jan. 28 to 30 | San Diego Marriott Marquis & Marina | San Diego

OneVoice is FSI's annual in-person gathering for the independent financial services firm community. OneVoice 2013 will give you a first look at what to expect this year, with insights into the election results, changing consumer behavior, technology trends in 2013, new regulatory and compliance developments, and much more! Visit here for more information on OneVoice 2013!

| SmartQuote |  |  |

|

| If I had my life to live over, I would perhaps have more actual troubles but I'd have fewer imaginary ones."

--Don Herold,

American humorist, writer and cartoonist

|

| |

| |

|

| |

| About FSI |

FSI was formed in January 2004 as an advocacy and membership organization for independent broker-dealers and independent financial advisors. We provide insight,

information, influence, and involvement--all in support of our mission to provide visibility, credibility, and an improved regulatory environment for the independent channel.

Learn more at financialservices.org

|

|

| |

| | Recent FSI Newsbrief Issues:

- Thursday, January 17, 2013

- Monday, January 14, 2013

- Thursday, January 10, 2013

- Monday, January 07, 2013

- Thursday, January 03, 2013

| | | SmartBrief Lead Editor: Sean McMahon

SmartBrief Mailing Address:

SmartBrief, Inc.®, 555 11th ST NW, Suite 600, Washington, DC 20004 | |

| |

|

| © 1999-2013 SmartBrief, Inc.® Legal Information |

|