Blu Putnam knows … a lot!

At FIA’s International Futures Industry Conference in Boca Raton, Fla., CME Group Managing Director and Chief Economist Blu Putnam gave a wide ranging presentation that focused on areas including energy, copper, the Euro, the S&P, geopolitics and agriculture. As with previous Bocas, Blu focused on identifying emerging trends, evaluating external factors, and forecasting their impact on global financial markets.

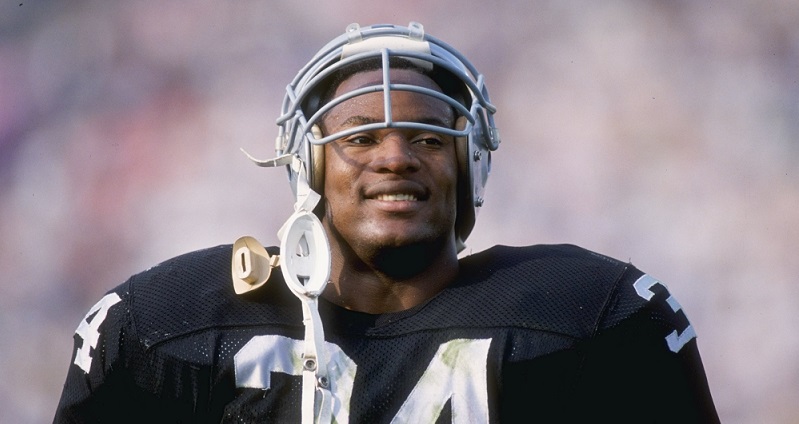

Like Nike’s Bo Jackson commercials from the 1990s, Putnam moved fast to cover a lot of ground in a lot of sectors. It was a Hall of Fame performance in economic cross-training, if you will:

Blu knows oil:

- Technology in the shale sector is getting much better and allowing for faster extraction.

- Due to efficiencies in extraction and smarter operation of equipment, costs are dropping.

- Higher production and inventory in the United States while OPEC is cutting extraction.

- Shale is more predictable versus traditional oil as the time to barrelling is only 15-16 months.

Blu knows agriculture:

- Trade and weather are the risk factors that affect agriculture more than anything.

- There currently is a lot of competition in global markets for agriculture.

- The U.S. is not in a drought anymore.

- No drought on the horizon for the growing regions so agriculture might grow well and keep prices low.

Blu knows copper:

- The rise in copper is a U.S. event due to the November election; traditionally it would be a worldwide event.

Blu knows China:

- Since 2014 Chinese GDP has started to level out.

- China’s government is running out of room to fund new projects.

- The Chinese government is managing the slow decline of the Chinese RenMinBi (CNY), already spending one trillion dollars to do so.

- The CHY is getting weaker as it edges back towards pre-2008 Olympic levels.

- 10% movement in the CNY is not too serious, but 25% movement will have a large impact.

Blu knows debt:

- Student loan debt is $1.7 trillion and is rising at 7% year over year; the most debt any generation ever has carried.

- Millennials will get married later, start families later, buy houses later, and so on due to debt.

- Auto debt is $1 trillion dollars, equating to $6,000 per American.

- Auto debt is not the same good debt it was five years ago; this debt is sub-prime debt.

- The U.S. national debt is $19 trillion with the Fed owning $2 trillion of it. (105% of GDP or >100% of GDP, respectively).

- High debt to GDP ratio is not necessary a bad thing, but you can only support a high ratio if you’re growing.

- The U.S. will probably not grow as fast as it once did.

Blu knows monetary policy:

- “I think the Fed is on a hike one, skip one routine for the rest of this year.”

- “Regardless of how you look at it, we are pretty much at full employment in the United States.”

Blu knows populism:

- Until this year’s elections in France and Germany, we won’t know if Brexit is a European blip or a trend.

And just like those Bo Jackson commercials, Putnam wasn’t afraid to stop and drop in a bit of wit.

Blu knows the quirks of tax laws:

- “You can call them a loophole if you don’t like them; you call them a deduction if you do like them.”