Programming note: WYWW is coming to you the rest of this week from Pershing’s INSITE 2017 conference in San Diego.

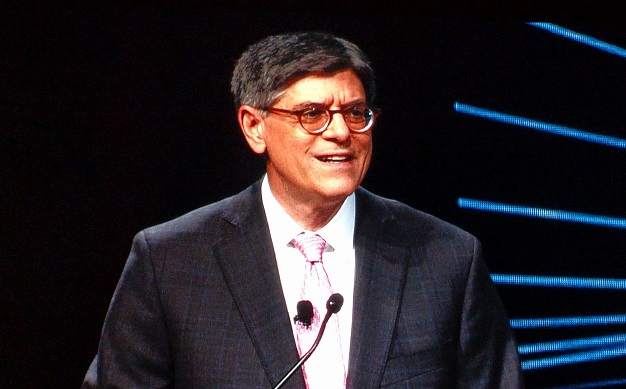

Jack Lew listed risks to the economy

In his keynote address at Pershing’s INSITE 2017 conference, former Treasury Secretary Jack Lew began with somber words regarding the shooting of Rep. Steve Scalise, R-La., and three others near the nation’s capital and then pivoted to some of the things he views as risks to the economy.

Interestingly enough, Lew doesn’t think any of the great threats to the economy are actually economic in nature. Lew is much more concerned with numerous geopolitical risks, as well as threats emanating from things like technology and cyberattacks.

Lew also noted the role technological advancements can play in the economy. Speaking on how technology effects an industry like manufacturing, Lew explained, “It is hard to find a lot of people in the places where a lot of people used to be.”

Amid all the various threats, Lew expressed mild amazement at how the VIX has remained steady.

Lew believes one or multiple of the threats facing the economy will eventually come to pass and the response that ensues, which needs to be measured and well-implemented, will ultimately determine the severity of the damage.

Pershing pushed further into tech for advisors

Pershing used the opening of INSITE 2017 to update the industry on the push the it is making into technology for advisors who use the firm’s NEXEN investment platform. Pershing plans to leverage artificial intelligence to develop tools to help advisors conduct their business. Pershing will also further its collaboration with enterprise and third-party APIs and plans to eventually open an App Store that will make the latest tools readily avaiable for advisors.

Chris Cox came out of hiding

Surprisingly little has been seen or heard of former SEC Chairman Christopher Cox since he left his post at the end of the George W. Bush administration. But Cox popped up at a recent conference and offered a familiar opinion that is music to the ears of derivatives traders.

“The El Dorado of financial regulatory reform for years has been harmonizing the overlapping regulatory authority of the CFTC and the SEC. The most obvious place to do that is the place where there’s the most overlap; the over-the-counter swaps markets.”

Cox is right. And if El Dorado is ever going to be found, there is as good a chance as any that it will be found during the Trump administration. After all, harmonized derivatives oversight is one of the few areas where market participants and policymakers agree that maybe one less regulator might mean more efficient regulation.

Virtu named Greifeld as chairman

Virtu Financial’s acquisition of KCG will be accompanied by another bit of savvy business by the electronic trading and market making firm: It has tapped former Nasdaq boss Bob Greifeld to be its new chairman. Greifeld knows the biz and will likely help Virtu continue on its march to increased market dominance.

WYWW Appetizers

- Yet MORE mischief at Wells Fargo.

- Morgan Stanley boss James Gorman batted his eyes at Saudi Arabia.

- Oh … and the Federal Reserve made some news today too.