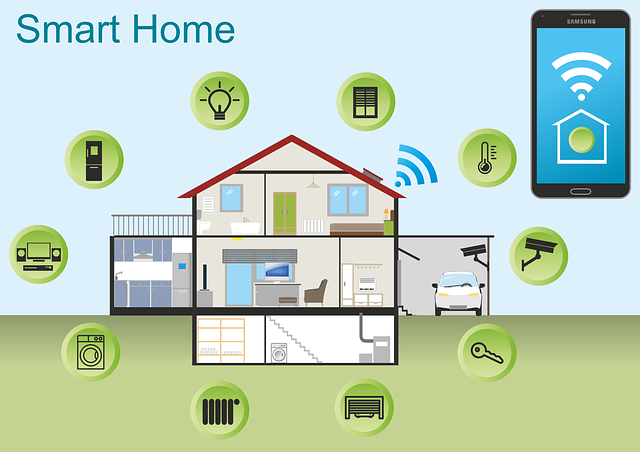

Smart speakers and other smart home technology are all the rage going into 2019. But what type of smart devices do consumers really own and aside from asking Alexa to tell jokes — which is the number one request in my household — how are consumers using this technology? The answers to these questions and more are here in the following five smart home technology trends, with results analyzed from a recent Ripple Street Research consumer survey.

Ownership will remain centered around speakers and watches, followed by thermostats/carbon dioxide monitors, security, lighting and outlets.

Smart speakers are the most sought-after item among smart home technology. It has been projected that over 50% of US households will own a smart speaker after the holiday season this year. Our research shows that 25 to 35% of consumers currently own and are interested in speakers and watches, which is many more than other smart devices like smart thermostats, video doorbells, carbon dioxide monitors, security cameras, smart lighting and outlets.

Meanwhile, there appears to be no current interest or need for all the fancy smart kitchen appliances compared to the rest of the smart home technology. That will come, but not in the near future.

Men are far more likely to own and gift smart home technology than women.

According to our research, men are three times more likely to own smart lighting and outlets, twice as likely to own smart speakers, thermostats, CO2 monitors and security systems and 67% more likely to own smart watches. Not only are they more likely to own a smart device themselves, but they’re also more likely to give one. The research shows men are 50% more likely to give a smart device as a gift this holiday season compared to women.

There is a huge opportunity for brands in these categories to connect with female consumers, educate them about the utility of these products and create an experience that allows them to feel informed and comfortable enough to purchase.

Men and women discover smart home technology differently.

Men are discovering new smart home products by reading blogs, articles, reviews and generally searching for information online. On the other hand, women are discovering smart home products primarily through recommendations from friends and family members. Women are twice as likely as men to discover a smart home product through friendly recommendations. With the complexity of most smart home devices, the data suggests that men seek the advice of a professional prior purchase, whereas women look to those that know them best.

Speakers are still not used for communication and purchase.

For all the talk about smart speakers changing the buying habits of consumers, most are not interested in using them to make purchases — or to talk to one another for that matter. Some of the most common uses for these speakers include listening to music, podcasts and more (94%), hearing weather forecasts (73%), setting alarms/reminders (58%) and asking fun questions (56%).

Everything else these speakers can do is used by less than half their owners — and only 29% use their smart speaker to make phone calls. Meanwhile, only a meager 20% report actually using devices to make purchases, but we know that number is likely to grow quickly.

Consumers say they are concerned about privacy, but it does not impact likelihood to purchase smart technology.

When specifically asked about privacy concerns, most consumers have them — 84% to be exact. However, it does not appear these concerns are a deterrent to purchasing a smart device., For those who do not currently own one, only 20% cited privacy concerns as the reason why; most others cited price (55%) and/or a lack of need (42%). As is the case with most technology these days, consumers are willing to ignore their privacy concerns as long as they see a need for the product.

David Smith is the VP of Research & Analytics at Ripple Street (formerly House Party, Inc.), an influencer marketing platform that connects brands with their biggest fans. He has been instrumental in the development of industry measurement standardization through his involvement with WOMMA/ANA and has worked with many Fortune 500 brands and top agencies on their influencer strategies and measurement.

For more marketing news, sign up for SmartBrief’s free email from the Social Business, among SmartBrief’s more than 200 industry newsletters.