Undoubtedly, more and more Chinese consumers are accustomed to shopping via livestreaming and the penetration rate of livestreaming e-commerce keeps increasing. According to iiMedia Research, as of June 2021, the number of China’s livestreaming users reached 638 million, an increase of 47.2% compared to the same period in 2020, accounting for 63.1% of internet users in China.

Data from research consultancy ASKCI also shows that the pandemic has given rise to a further boom in the “stay-at-home economy,” stimulating the growth of the livestreaming e-commerce industry. The livestreaming e-commerce market size expanded 121% in 2021 compared to the previous year, reaching 961 billion RMB ($143 billion US). China’s livestreaming e-commerce market size is expected to rise by an additional 150.73 billion RMB ($22.45 billion US) in 2022.

Recently, exercise livestreamers Liu Genghong and his wife Wang Vivi sparked a fitness revolution on Douyin. Liu, through Douyin livestreaming, led fans to exercise together, reaching 35 million followers in 10 days. A single livestream of up to 44.76 million views also set the latest record for Douyin livestreaming in 2022.

Douyin is a booming short-video app in China. According to Statista, as of February, Douyin reported having 86.8% of its users livestreaming content in China and its users spent at least 89 minutes watching videos on the platform each day. In this article, we analyze the characteristics of Douyin livestreaming, the differences from other platforms, and why Douyin livestreaming is a future trend to watch.

The characteristics of Douyin livestreaming

Douyin livestreaming is growing rapidly. Short-video is its main driver of traffic and algorithm-powered curation makes sure the right viewers are watching. Douyin’s traffic approach creates tremendous potential for virality and high user loyalty.

Different from other platforms, Douyin’s advantage lies in the content ecology, and its unique short video + livestreaming combination model has also become the marketing strategy of many businesses. Short videos are responsible for seeding and can attract traffic for livestreaming, effectively stimulating user demand and conversion efficiency.

According to the Douyin 2022 Ecosystem Conference, Douyin livestreams over 9 million sessions per month, with gross merchandise value (GMV) growing 3.2 times year-over-year. It’s that type of content that seems to be a main driver of e-commerce growth by Douyin’s users. Data show the number of orders from livestreams increased 112% compared to April 2021.

Also, the personal characteristics of Douyin’s livestreaming are strong. Each anchor has their own style, image and a fixed audience base, and some anchors even make their live room into a trademark. For example, with Luo Yonghao’s “Make Friends Livestream Room,” this kind of livestreaming with distinctive and unique personal characteristics is actually the reason why users like to watch the livestreaming on Douyin.

Instead of continuously going on about the same goods, you can see the anchor going on to match the different categories and products according to his/her personal style.

For the two years preceding April 1, the total GMV of “Make Friends Live Room” reached 10 billion RMB ($1.5 billion US), the total livestreaming time has exceeded 10,000 hours and the transaction order volume has reached 55.51 million pieces. During the period, the number of participating brands in the live room exceeded 6,500 and the number of products reached 43,000. Since most of the viewers are interested in the products or are fans who’ve tuned in before, they have a trusted connection with the host.

In addition to livestreaming e-commerce, Douyin has also held livestreaming of university classes, sports events and music concerts.

At the same time, various forms of livestreaming, such as Lianmai (interactive live broadcasts) and group-buying, have increased significantly, which has fueled the development of the livestreaming ecosystem.

Douyin livestreaming has an increasing penetration rate in users’ daily life and has been accepted by more and more users. According to a report by Douyin Live, the number of viewers of popular science livestreams increased by 283% in 2021, and the number of traditional culture livestreams increased by one million year over year.

Livestreaming on different platforms

Taobao

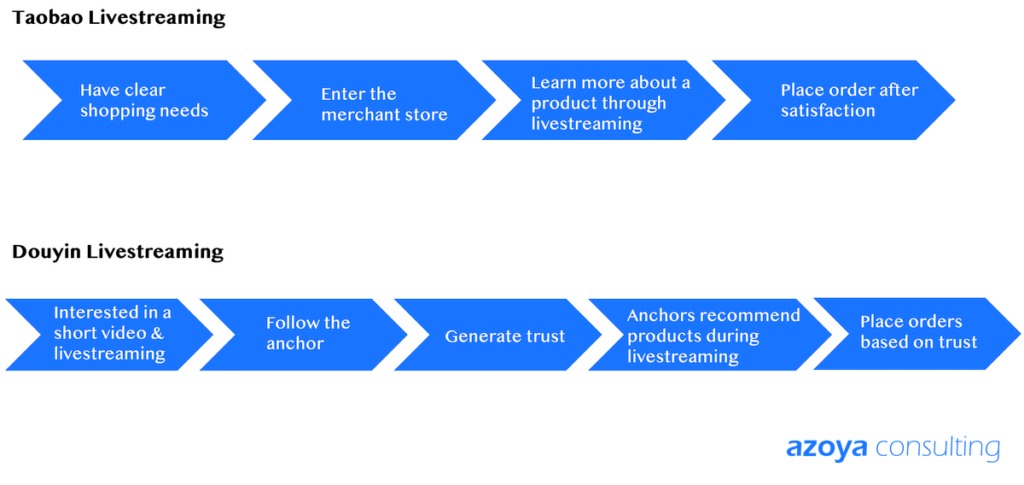

The biggest difference between Taobao livestreaming and Douyin livestreaming is that users themselves have shopping needs, whether vague or specific. Therefore, when users watch Taobao livestreaming, they want to be more specific and targeted to understand a certain product, see product demonstrations and interact with the anchor. Overall, users’ shopping needs on Taobao are active, not passive.

Livestreaming has been integrated into various segments of the Taobao ecosystem and plays an important role in many campaigns, such as shopping festivals. However, compared with Douyin livestreaming, Taobao Live’s content ecosystem and entertainment properties are weak.

In fact, the entertainment properties of traditional e-commerce platforms like Taobao and JD.com are not strong. Since users tend to have a specific reason when they access the app — to browse, search, and purchase — watching livestreaming is not a very high-frequency behavior. On the contrary, Douyin users want to be entertained, so they are prone to make purchases quickly and buy on impulse, driven by livestreaming scenarios and entertaining content, resulting in a higher user’s average length of time in Douyin.

How anchors are used on Taobao and Douyin also is different.

In Douyin, there are livestreaming rooms with different positioning, such as brand livestreaming rooms, corporate livestreaming rooms, and personal key opinion leader (KOL) and key opinion consumer (KOC) livestreaming rooms. This has resulted in a large number of anchors on Douyin, and consumers who love to watch livestreaming will also come into contact with different kinds of livestreaming rooms. Douyin e-commerce data shows that in the past year, 1.8 million new merchants have launched on Douyin, and 3.86 million influencers have promoted products via livestreams.

This is very different from Taobao’s livestreaming, where the vast majority of traffic is concentrated in the top anchors. According to Xiaohulu data, the total sales of Taobao Livestreaming’s top two anchors in September 2021 exceeded the sum of the rest of the top 30 anchors combined.

Therefore, Taobao’s mid and micro anchors do not have sizable traffic and fan bases, and the overall number of anchors is relatively small compared to Douyin.

WeChat Channel

As a social e-commerce platform, WeChat Channel has two major advantages that other e-commerce platforms do not have: establishing trust in the private domain (a company’s own database for consumer outreach) and accumulating users’ data. For creators of WeChat Channel, private domain will become long-term assets for sustainable operation.

In addition, the livestreaming function of WeChat Channel is constantly improving and the system is gradually maturing. WeChat Channel has a livestreaming reservation function, which allows users to make a reservation and watch the livestreaming through the system reminder after the time is up. At present, the viewing rate of WeChat Channel livestreaming with reservation is over 50% and the repurchase rate exceeds 60%.

Compared with other platforms’ livestreaming, WeChat Channel livestreaming has a clearer strategy. It opens up a new complete customer journey of WeChat ecosystem, closely connected with WeCom (also known as WeChat work), official account, WeChat group, WeChat moments and mini-programs, which can conveniently help businesses import target users into the private domain and lay the foundation for subsequent accurate marketing and refined operations. WeChat Channel livestreaming allows the public and private domains of WeChat ecosystem, social and transformation to be combined.

In general, the WeChat Channel is now more focused on social attributes and acquaintance relationships. This is also very different from the strong entertainment properties of Douyin, and the loyalty between the anchors and users of WeChat Channel is currently not as high as Douyin.

Douyin livestreaming e-commerce

On May 13, the internationally-renowned beauty brand Lancome officially debuted on Douyin with flagship store. Within a month of opening, Lancome sold more than 1 million RMB ($150,000 US) in 10 days and 10 million RMB ($1.5 million US) in cumulative sales. In the “Douyin 520 Confession Season,” the total transaction sales reached 5 million RMB ($745,000 US).

It is worth mentioning that, in the first livestream of the store opening, Lancome worked with top KOLs, such as “Xianmu,” “Yizhi Nannan” and “One is a Black Cat,” and livestreamed product application and makeup tutorial. The livestreaming attracted more than 200,000 viewers, and the single livestream exceeded one million likes.

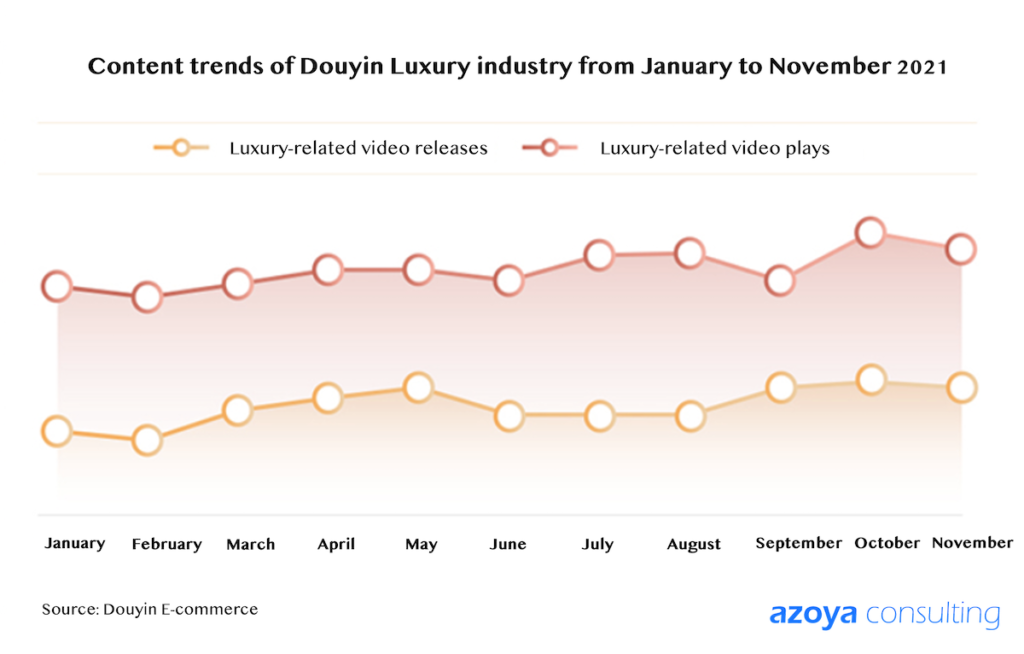

In addition to beauty brands, luxury brands have also accelerated the pace of entry into Douyin. American label Michael Kors became the first upmarket brand to work with Douyin in November 2017. Many other big names followed suit, including Louis Vuitton, Gucci and Dior.

On July 24, 2021, celebrity Qi Wei and COACH partnered to launch a livestream in Douyin, bringing COACH X BAPE 2.0 co-branded limited edition to fans. The livestream lasted for 6 hours, attracting countless users, with a maximum of 102,300 people online at the same time for a total of 8.896 million people watching the livestream. According to the data, the GMV of this special livestream reached 5.97 million, and all the COACH X BAPE cooperation models sold out.

In addition to brands flocking to Douyin, livestreaming also played an important role in Douyin’s shopping festival activities. According to the Douyin livestreaming e-commerce research report, more than 98% of the GMV of Douyin’s three large marketing events in recent years incorporated livestreaming (8.18 Shopping Festival in 2020, 6.18 Shopping Festival in 2021, and 8.18 Shopping Festival in 2021).

In Douyin’s 2021 8.18 campaign, the top 20 KOLs live-streamed a total of 242 sessions, generating over 2.8 billion RMB ($420 million US) in sales, with average sales of 11.82 million RMB ($1.76 million US). Overall, the spending power of Douyin users on shopping festival activities still maintains strong growth momentum.

In the 8.18 promotion campaign in 2021, the brands with the top 20 sales will all develop self-livestreaming. 75% of the brands will associate with more than 100 KOLs in their campaigns, using high-quality KOL resources to bring them strong exposure and improve sales conversion. In addition, the top 20 brands in terms of sales all adopt the combination strategy of short video and livestreaming.

From the data performance, Douyin livestreaming has become a new online traffic hub. Moreover, there are more pure commission models in the Douyin livestreaming, which also reduces the risk of between brands and anchors. In addition, tools such as the Volcano Engine, an intelligent technology service platform launched by ByteDance. can also help brands choose suitable anchors for cooperation.

In the long term, in China’s highly competitive market, no one is sure how long Douyin’s traffic growth will last, but current data shows that brands should continue to choose to pay attention to the platform’s marketing and sales potential.

Livestreaming is continuously growing

The function of livestreaming e-commerce demonstrates that it is not only a new marketing method, but also represents a growing sales channel via streaming anchors or influencers, whose sales-driving potential cannot be underestimated. According to Research And Markets, China’s livestreaming market is anticipated to reach $76.42 billion US in 2025, experiencing growth at a compound annual growth rate (CAGR) of 35.29% during the period spanning from 2021 to 2025.

For brands looking to succeed in China’s retail market, livestreaming e-commerce is already an integral part of the omnichannel marketing strategy that cannot be ignored.

However, in the face of such a growing market, merchants also need to master the characteristics and marketing strategies of emerging platforms other than the mainstream e-commerce platforms, such as Taobao and JD, in order to maximize business growth.

While livestreaming still has many unknowns, what we do know is that it’s on track to take off in the e-commerce market.

Key takeaways:

- For US brands in China, Douyin is turning out to be a promising platform that you cannot underestimate to access Generation Z, millennials and other consumers. The younger and newer consumers are attracted by livestream and short-form video content.

- With many brands still reluctant to join Douyin sales channels, Bytedance is now showing greater ambition in the e-commerce space, and Douyin providing supportive measures to new players.

- Douyin’s first official 618 festival was a success. Douyin E-commerce revealed that, from June 1 to 18, Douyin e-commerce livestream totaled 40.45 million hours, and short videos linked to shopping carts were played 115.1 billion times.

- To fully take advantage of livestream, brands need to actively drive virtual footfall: for instance, by picking the appropriate KOL and anchors from the right industry to work with.

Franklin Chu is managing director U.S. for Azoya International, a provider of turnkey cross-border e-commerce solutions to assist retailers looking to expand into China through a cost-effective and lower risk method. To date, over 35 retailers in 11 countries are partnering with Azoya to expand into China with ease.